With more convenient ways to spend money, the amount of consumer credit card debt has reached an estimated $1.021 Trillion in 2017, This beats the previous record set in 2008 of $1.02 Trillion. Credit The average American household has $16,000 worth of credit card debt, while carrying close to $135,000 if you include other debts including mortgages.

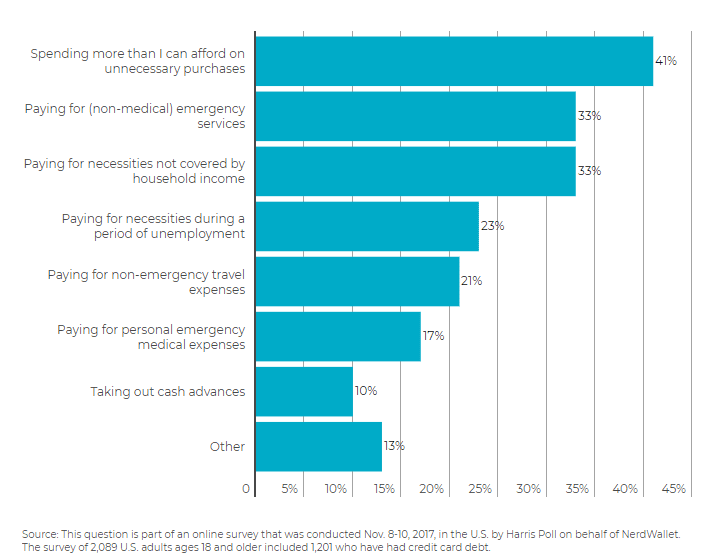

According to a study done by NerdWallet, income has not been keeping up with the rise of costs across many categories including medical, food, housing, and expenses generally categorized as “other”. The top reason for this increase from the 2000 American adults that were surveyed, was an increase in unnecessary purchases that were outside of their budgets, with medical expenses taking second place.

Not everyone knows how to combat their debts. Some might not even know they can combat it. Saving your financial future takes work, and no one is going to pay your debts for you. Fortunately you can take some steps to save yourself some cash and give yourself some peace of mind. Here are some factors you can get a handle on.

Interest is one of the many factors that can crush you when it comes to credit card debt. Many cards have a high interest rate which means making the minimum payment is really making your debt larger. It is generally best to find out which card has the highest interest rate and pay as much as you can towards it to reduce how much interest you are accruing.

Make a budget and stick to it. This is commonly said but rarely followed. You cannot go into debt if you don’t spend more than you have, it’s a simple as that! As already noted in this article, 41% of the people surveyed, acknowledged purchasing items they recognized as unnecessary. Adhering to a budget will not only help you get out of debt, but after y

Talk To a Debt Coach

If you wanted to lose weight, gain muscle and increase your athletic performance, you’d talk to a personal trainer. If you wanted to learn Yoga, you’d work with a Yoga instructor. You get the point, success in any endeavor is more likely when you model the appropriate behavior that has a track record of success. Tackling your debt is no different. You need to take action, to get out of debt as quick as possible, saving as much as possible, all while keeping your monthly payment as low as you can.

ou are free and clear it will prevent you from going back into debt again.